Listen to the article

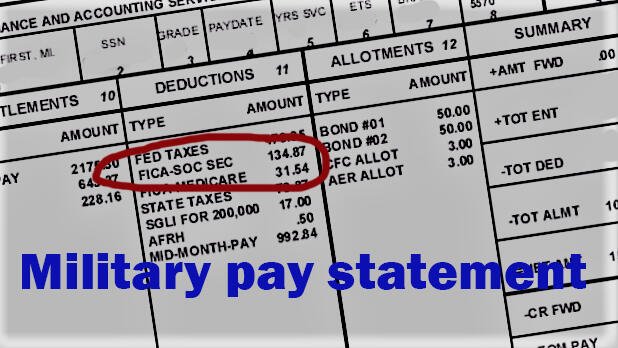

Military pay deductions are an important part of your total pay situation. They are one of the two types of money withheld from your pay before it is paid to you. Deductions are shown in the middle column of your monthly Leave and Earnings Statement (LES), and sometimes there are a lot of them. Understanding your pay deductions helps you know where your money is going.

Understanding the Mid-Month Pay Deduction

Every service member has a deduction on their monthly LES that represents their mid-month pay. Military pay is calculated on a monthly basis. The mid-month pay deposit is essentially a micro-loan of half of the amount of your estimated total monthly pay and allowances, minus deductions.

The math for your mid-month pay is done around the 6th of the month, and the Defense Finance and Accounting Service (DFAS) can only use the information it has at that time. If DFAS receives information that changes your total monthly pay amount after it has calculated mid-month pay, then your mid-month pay and your end-of-month pay will be different amounts. This might include the start or stop of allowances, a change to BAH rates following a move or a change in dependency status, or the start or stop of an allotment.

Because this mid-month pay is a micro-loan, it has to show up on your monthly LES somewhere. And where it shows up is as a deduction. Otherwise, your LES wouldn’t balance out.

Common Deductions

These are some of the deductions frequently listed on a military LES.

AFRH: This is a contribution to the Armed Forces Retirement Homes. This is mandatory for enlisted folks.

Federal Taxes: Federal taxes are withheld from each paycheck based on your instructions given on your W-4 Withholding form. You can change your withholding information via the MyPay portal.

FICA – Soc Security: All employees pay Social Security taxes of 6.2% on income up to an annual cap. The cap for 2026 is $184,500. There is no Social Security tax on income beyond that level.

FICA – Medicare: All employees pay into Medicare at 1.45% of their income each year.

MGIB: If you elected to participate in the Montgomery GI Bill program, you will have $100 deducted each month for the first 12 months of service.

Meal Deduction: Whenever a service member is in a position where they are expected to eat meals in the dining facility (or on the ship), the cost of those meals will be deducted automatically.

Roth TSP: If you have directed DFAS to make contributions to a Roth Thrift Savings Plan account, those contributions will show up here.

SGLI: Servicemembers’ Group Life Insurance premiums. Every service member is enrolled in SGLI at the default rate of $500,000 in coverage. Your SGLI payment also includes a small amount for your Servicemembers Group Life Insurance Traumatic Injury Protection (TSGLI).

SGLI FAM/Spouse: Servicemembers’ Group Life Insurance premiums for spouses. These are based on your spouse’s age.

State Tax: State taxes are withheld from your pay according to the instructions you have provided to the military through your DD Form 2058, State of Legal Residence Certificate, and to DFAS through your state W-4. If you think you need to make adjustments here, you can do that via your MyPay account.

TSP: Contributions made to a traditional Thrift Savings Plan account, per your directions, are listed here.

Less Common Deductions

The following deductions appear less frequently.

AAFES: If you owe a debt to the Army and Air Force Exchange Service, the money may come directly out of your paycheck.

Debt: If you owe the government a debt, payments will show up here.

Fine: If you’re found guilty of a military charge and ordered to pay a fine, this will be taken directly from your pay.

Garnishment: If a creditor goes to court and is awarded damages against you, they may have a portion of your income garnished directly from your pay.

GPLD: This stands for Government Property Lost or Damaged. The cost of unreturned equipment can be deducted directly from your pay.

Partial Pay: Partial pay is used for a variety of situations, including early release of funds in a Temporary Lodging Allowance situation, along with other circumstances in which the government prefers to release pay funds outside of the usual semi-monthly schedule.

Pay Released: This is used in conjunction with certain deductions that are handled similarly to allotments, such as child support or spousal support (see below).

Prior Supp/Com: This is part of the excessive way the military accounts for court-ordered child support or spousal support. It shows up three times in the Deductions column, twice as deductions and once as the opposite of a deduction.

Repay Advance: This usually represents the repayment of advance pay.

Split Pay Option: This is used by sailors to have a portion of their pay designated to be available on shipboard bank machines. It is an LES nightmare, as the split pay accounting shows up numerous times in just one LES.

SPO Payment: This is part of the Split Pay Option accounting. Basically, this part tracks the two “payments” made by the service member into their imaginary split pay account.

Support/Comm Debt: This usually represents court-ordered child support payments being taken directly from the service member’s pay and paid by DFAS.

If you have a deduction on your LES and aren’t sure what it means, you have a couple of ways of finding out. First, your installation probably has a personal financial manager or personal financial counselor, usually located in the family readiness center. You can ask your personnel folks. Or you can use the internet.

Understanding what deductions are coming out of your pay is key to knowing where all your money is going. More importantly, mistakes happen. The quicker you notice an incorrect deduction, the faster and easier you can get it fixed.

Previously in this series:

Part 1: 2026 Guide to Pay and Allowances for Military Service Members, Veterans and Retirees

Get the Latest Financial Tips

Whether you’re trying to balance your budget, build up your credit, select a good life insurance program or are gearing up for a home purchase, Military.com has you covered. Subscribe to Military.com and get the latest military benefit updates and tips delivered straight to your inbox.

Story Continues

Read the full article here

25 Comments

The various deductions listed on the LES, including FICA – Soc Security and FICA – Medicare, can be overwhelming to navigate, but understanding each one is crucial for effective financial planning.

The Roth Thrift Savings Plan account contributions, which show up as a deduction on the LES, are a great way for service members to save for retirement and reduce their taxable income.

The mid-month pay deduction on the Leave and Earnings Statement is essentially a micro-loan of half of the estimated total monthly pay and allowances, minus deductions, which is calculated around the 6th of the month.

The $100 monthly deduction for the Montgomery GI Bill program for the first 12 months of service is a significant investment in one’s education and future career prospects.

I’m curious about how the deductions on the LES affect service members’ credit scores and overall financial health, and whether there are any strategies to mitigate any negative impacts.

I’m supportive of the automatic deductions for important benefits like SGLI and TSGLI, as they provide essential protection and support for service members and their families.

The article highlights the importance of reviewing and understanding the LES, particularly the deductions section, to ensure accuracy and make informed financial decisions.

The automatic deduction of Servicemembers’ Group Life Insurance premiums, including the default rate of $500,000 in coverage, is an important aspect of financial planning for service members and their families.

Additionally, the inclusion of a small amount for Servicemembers Group Life Insurance Traumatic Injury Protection (TSGLI) provides extra protection and peace of mind.

I’m curious about how the Defense Finance and Accounting Service (DFAS) handles changes to total monthly pay amounts after mid-month pay has been calculated, such as the start or stop of allowances.

According to the article, if DFAS receives information that changes your total monthly pay amount after it has calculated mid-month pay, then your mid-month pay and your end-of-month pay will be different amounts.

I’m wondering if there are any resources or tools available to help service members better understand and manage their deductions, such as financial counseling or online resources.

The fact that the mid-month pay deduction is calculated based on estimated total monthly pay and allowances, minus deductions, makes it essential to regularly review and update one’s financial information.

I’m wondering if there are any plans to simplify or streamline the deductions process, making it easier for service members to navigate and understand their financial situation.

I’m concerned about the potential for errors or discrepancies in the deductions listed on the LES, and whether there are procedures in place to address and correct these issues.

I’m concerned about the potential impact of state taxes on take-home pay, as these can vary significantly depending on the state in which the service member is stationed.

The importance of understanding the mid-month pay deduction and other deductions on the LES cannot be overstated, as it has a direct impact on take-home pay and financial planning.

The fact that federal taxes are withheld from each paycheck based on the W-4 Withholding form instructions is an important consideration for service members, as it can affect their overall tax liability.

I’m wondering how the meal deduction works when a service member is in a position where they are expected to eat meals in the dining facility or on the ship, and whether this deduction is subject to change based on individual circumstances.

I’m curious about how the mid-month pay deduction is reflected on the LES, and whether it’s clearly labeled as a micro-loan or a deduction.

According to the article, the mid-month pay deduction shows up as a deduction on the LES, which can be confusing if not properly understood.

The mandatory contribution to the Armed Forces Retirement Homes (AFRH) for enlisted personnel is an important deduction to understand, as it affects their overall take-home pay.

I’m skeptical about the 6.2% Social Security tax on income up to the annual cap of $184,500, as it seems like a significant deduction from one’s paycheck.

However, it’s worth noting that there is no Social Security tax on income beyond the annual cap, which may provide some relief for higher-earning service members.

The article provides a helpful overview of the common deductions listed on a military LES, but I would like to see more information on how to manage and optimize these deductions for maximum financial benefit.